Need cash for Venture capital?,Home renovation?,Education?

BFI Finance is ready to help youApplication quickly approved

Long term up to 48 months

Application quickly approved

Long term up to 48 months

BFI Finance is licensed and supervised by Otoritas Jasa Keuangan

Why Choose BFI Finance?

BFI Finance is ready to meet your financial needs

-

Funding without Additional Fee

Get full funds to meet your needs

-

Low Interest

Interest starts from 0.76% per month, with annual interest rates starting from 10.86%

-

High funding

Liquid financing starts from Rp10 million to 95% of the vehicle value

-

Funding without Additional Fee

Get full funds to meet your needs

-

Low Interest

Interest starts from 0.76% per month, with annual interest rates starting from 10.86%

-

High funding

Liquid financing starts from Rp10 million to 95% of the vehicle value

Easy Financing Process

Apply the easy way, follow the steps below

-

1. Online Form

Fill out the form and complete your personal data so that the loan submission can be processed

-

2. Confirmation

After the data is completely filled in, you will be contacted by our Call Center

-

3. Survey

BFI Finance will conduct a survey for the next process

-

4. Loan Disbursement

Loan funds will be disbursed to a registered account

Car BPKB Collateral Loan Simulation

Plan Your Financing for Free

Disbursement of Funds Up to

Rp500.000.000

Pilih Merek Kendaraan

Tenor | Angsuran

Apply now to get a calculation tailored to your needs. The process is fast and reliable!

*The financing amount is an estimate. The financing amount is determined based on the vehicle's condition verification.

Domicile

ndf-asset-type-select

-

ndf-asset-model-select

-

ndf-asset-year-select

Mohon maaf kendaraan Anda tidak tersedia

Silakan coba dengan kendaraan lain

Important Information You Need to Know

BFI Finance Receives BPKB Car Guarantee Loan

Personal Profile

- Indonesian citizens

- Aged 21-60 years and marital status is not married, married and divorced

- The status of home residence, couple, family, annual contract

- Occupation :

- Employees (Permanent/Contract)

- PNS

- Entrepreneur

- Cannot be accepted if the type of business/profession violates the law

Vehicle Profile

- The car is your own vehicle with the original BPKB

- BPKB can be in the name of yourself, your partner or someone else (Attach proof of purchase)

- BPKB can be in the name of the company provided that it attaches an SPH (Letter of Release of Rights)

- Vehicle age

- Maximum 20 years (minimum vehicle year 2005 for sedans, jeeps and minibuses)

- Maximum 13 years (Minimum Year of Vehicles 2012 for Pick-Up and Truck Cars)

- STNK / Tax

- In Your Own Name

- Still Available

- Expired Tax maximum 2 years (will be deducted from the disbursement amount)

- In the Name of Another Person

- Alive

- Expired Tax (Return Name in BFI)

- In Your Own Name

- Black Plate

- Yellow Plate (Truck Special)

What is Unacceptable (non-eligible condition)

- Red plate vehicle

- The vehicle was once used as a taxi or ambulance

Easy Requirements

Your loan funds can be directly processed by preparing the documents below

Applicant's and Spouse's ID Card (If married)

Family Register

Electricity Bill

Proof of Income

Vehicle Registration

Vehicle Ownership Certificate

BFI Dana Express Car Installment Scheme - Car BPKB Collateral Loan

|

Loan |

Rp50,000,000 |

|

Time Period |

12 months or 1 year |

|

Interest |

Rp50,000,000 x 0.76% x 12 months = Rp4,560,000 |

|

Total Loan |

Rp50,000,000 + Rp4,560,000 = Rp54,560,000 |

|

Installment / month |

Rp54,560,000 / 12 months = Rp4,546,000 |

*The installment scheme is only a simulation and is not a loan agreement. The numbers can change and be adjusted based on further assessments in accordance with BFI Finance's policy.

Things you need to know if you apply with a car BPKB guarantee at BFI Finance

|

Flat Rate per Month |

Low interest rates starting from 0.76% to 1.1% flat per month |

|

Minimum and Maximum Interest Rates per Year |

Starting from 9.16% - maximum 14.34% (depending on asset condition & completeness of documents) |

|

Minimum and Maximum Loan |

Starting from IDR 10 million to 95% of the vehicle value |

|

Domicilie |

All of Indonesia, except Aceh |

|

Minimun & Maximum Installments (Tenor) |

3 Months to 48 Months |

Customer Success Stories

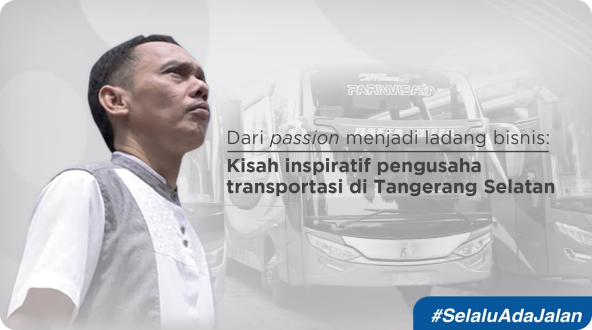

“In 2014, I entrusted the guarantee of vehicles to BFI Finance to develop the fleet and increase capital.”

Deddy Setiawan

Transportation Service Entrepreneur

Frequently Asked Questions

Funds that can be borrowed start from IDR 10 million to 95% of the vehicle value

The vehicle profiles that can be borrowed are as follows:

- The car is your own vehicle with the original BPKB

- BPKB can be in the name of yourself, your partner or someone else (Attach proof of purchase)

- BPKB can be in the name of the company provided that it attaches an SPH (Letter of Release of Rights)

- Vehicle age

- Maximum 20 years (Minimum Vehicle Year 2004 for sedans, jeeps and minibuses)

- Maximum 13 years (Minimum Vehicle Year 2011 for pick-up cars and trucks)

- STNK / Tax

- In Your Own Name

- Still valid

- Dead Tax maximum 2 years (will be deducted from the disbursement amount)

- In the Name of Another Person

- Life

- Dead Tax (Change of name in BFI)

- In Your Own Name

- Black Plate

- Yellow Plates except for special commercial yellow plate transportation ( public transportation & taxi)

Prepare initial requirements documents, such as:

- KTP of the applicant (and partner if married)

- Family Card

- Electricity Account / PBB

- Proof of Income

- STNK & BPKB

Click Apply now and please fill out the financing application form on our website, then our call center will contact you, make a survey schedule. After that, the data is sent to the nearest branch from your domicile for physical verification of the guarantee unit.

BPKB can be in the name of yourself, your partner or someone else (Attach proof of purchase)

Safe because BFI Finance is licensed and supervised by the Financial Services Authority

Have further questions? Contact Us

Enjoy a fast disbursement process by completing the existing requirements

Benefits of Applying for a Car BPKB Guarantee Loan

Long tenor ranging from 3 to 48 months

Financing from 10 million to 95% of vehicle price

Low interest starting from 0.76% per month